Cash flow forecasting involves estimating your future sales and expenses. A cash flow forecast is a vital tool for your business because it will tell you if you’ll have enough cash to run the business or expand it. It will also show you when more cash is going out of the business than in.

A cash flow forecast is in essence a cashbook that projects you or your business’s income and outgoings for any given period in the future, eg week, month, quarter or financial year.

For each period, it lists:

It’s typically presented as a spreadsheet, but many contractors, sole traders and small businesses use accounting software ( we use MYOB and Xero) and work with their accountants or bookkeepers to ensure greater accuracy.

A cash flow forecast is only as valuable as the information and detail put into it.

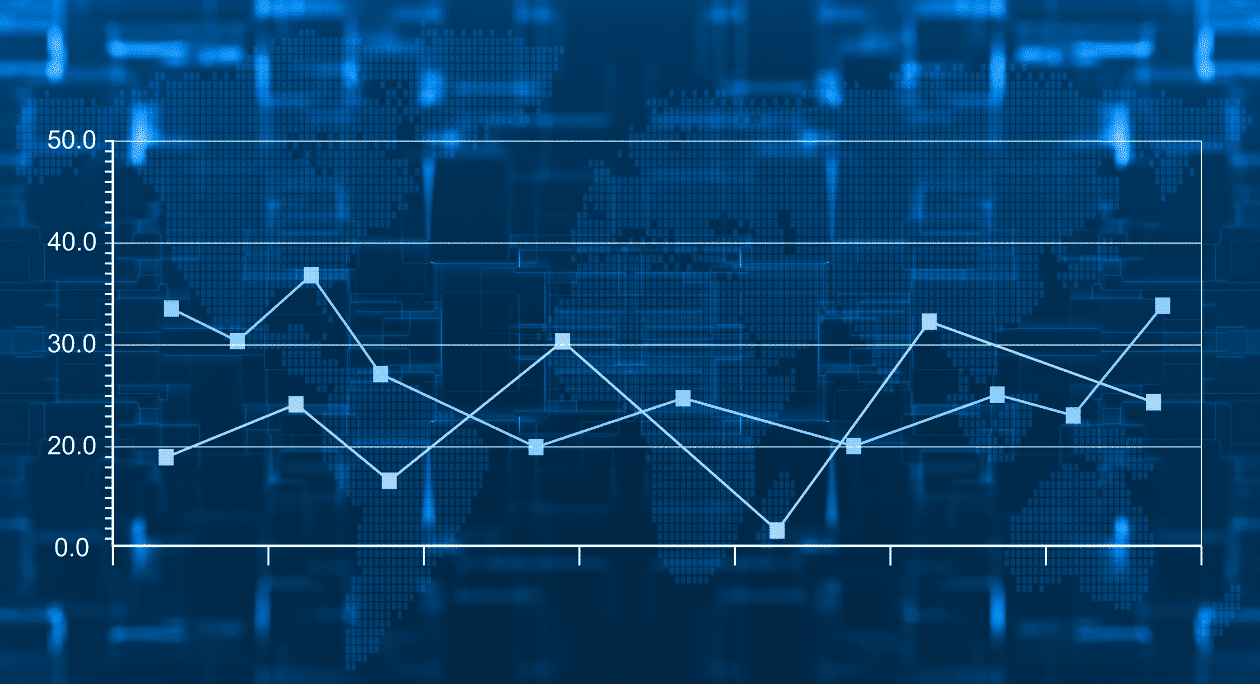

Your business’s cash flow is represented in a cash flow statement. A positive cash flow will have more money coming in than going out.

You can improve your cash flow by:

Here are a few steps on how to do this:

First, decide on a period that you want to forecast. Most people choose monthly.

To forecast your sales, look at last year’s figures to see if you can spot any trends. You can make adjustments to your sales forecast based on whether sales increased, decreased or stayed the same.

If you’re a new business and don’t have past sales figures, start by estimating all the cash outflows. This will give you an idea of how much money the business needs to bring in to cover it.

But keep in mind that sales figures can change all the time depending on:

Next, you’ll estimate your ‘cash inflows’, or sources of cash other than sales. These will vary from business to business but might include:

When you calculate your cash outflows, work out what it costs to make goods available. This way, if you need to adjust your sales numbers later (for example, if you actually sold 10 units in March when you thought you would sell 5), it will be easier to adjust the actual cost of goods sold.

Expenses can be money spent on administration or operation. These will also depend on the type of business.

Beyond its normal running expenses, cash leaves a business (‘cash outflows’) in other ways. Examples are:

Since cash flows are all about timing and the flow of cash, you’ll need to start with an opening bank balance – this is your actual cash on hand.

Next, add in all the cash inflows and deduct the cash outflows for each period. The number at the end of each period is referred to as the closing cash balance. This will be the opening cash balance for the next period.

Once you’ve done your cash flow forecast, make sure you go back and check what you estimated against the actual cash flows for the period. This is the most important step. Doing this will highlight any differences between estimated and actual so you can see why your cash flow didn’t meet your expectations.

If you’re not going to be bringing in enough money to sustain your business, you can then take steps to improve your cash flow.

We have a team of experts at your fingertips who can help you with a robust onboarding system.

Resources: Thank you to the following for their content: ANZ Bank, Ministry of Business, Innovation and Employment, and Business Victoria.

EXCELLENTTrustindex verifies that the original source of the review is Google. Colin at EC Credit Control provided us with clear and comprehensive terms of trade for our business. Their professionalism and attention to detail made the process smooth and stress-free. Highly recommend their services!"Trustindex verifies that the original source of the review is Google. Super stoked with EC Credit Control - They fulfilled all our requirements for our customers TOT's. They also offer a great PDF fillable account for which makes filling them out a whole lot easier. Shaun at EC was extremely good to deal with. Prompt quick turnaround service, highly recommend.Trustindex verifies that the original source of the review is Google. Shona at EC Credit Control was excellent. She gave me fantastic advice, and was great at communicating with me quickly. Highly recommend their services if you need someone to collect a debt for your business.Trustindex verifies that the original source of the review is Google. Fantastic professional service I highly recommendTrustindex verifies that the original source of the review is Google. Great company to deal withTrustindex verifies that the original source of the review is Google. Great team, great communication and great results. Thank you so much for your help!Trustindex verifies that the original source of the review is Google. We are fortunate to have Toni as our credit consultant. He is exceptionally professional, patient, and consistently takes the time to explain complex concepts in a clear and understandable way. His support has been invaluable to our team.Trustindex verifies that the original source of the review is Google. Great to work with, makes everything super clear and easy to implementVerified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more

Our business is NZ owned.

EC Credit Control (NZ) Ltd